Illegal Uses of Social Media

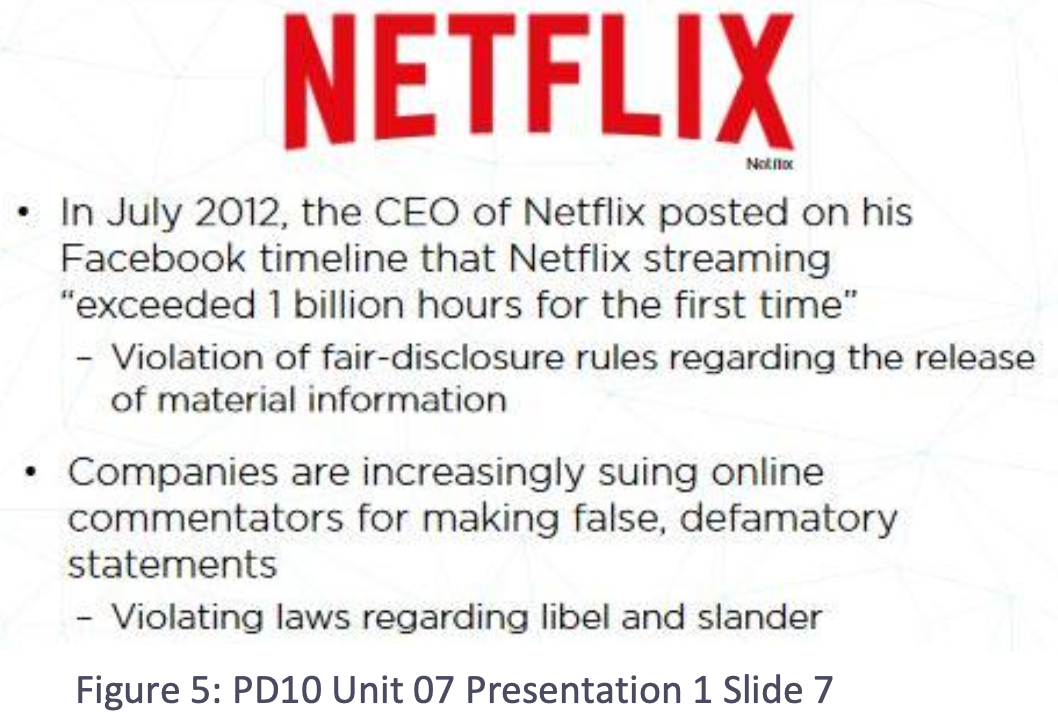

Even the use of new software technologies, like social media, can have surprising interactions with existing laws.

Other companies have also performed securities’ violations by posting company information on Facebook and Twitter. These behaviours suggest a conflict between using social media to reach new audiences and running afoul of these disclosure rules.

Another legal concern is the increasing use of blogs, online review forums, and social media to launch malicious attacks against companies or products. When the attacks are relentless, companies fight back with defamation suits.

In the past, such suits tended not to be very successful. However, because of the wide reach of the Internet, attacks on websites and social media can have a devastating impact on a company’s reputation and sales. In response, courts are increasingly finding in favour of the defamed companies and are awarding them large sums in damages.

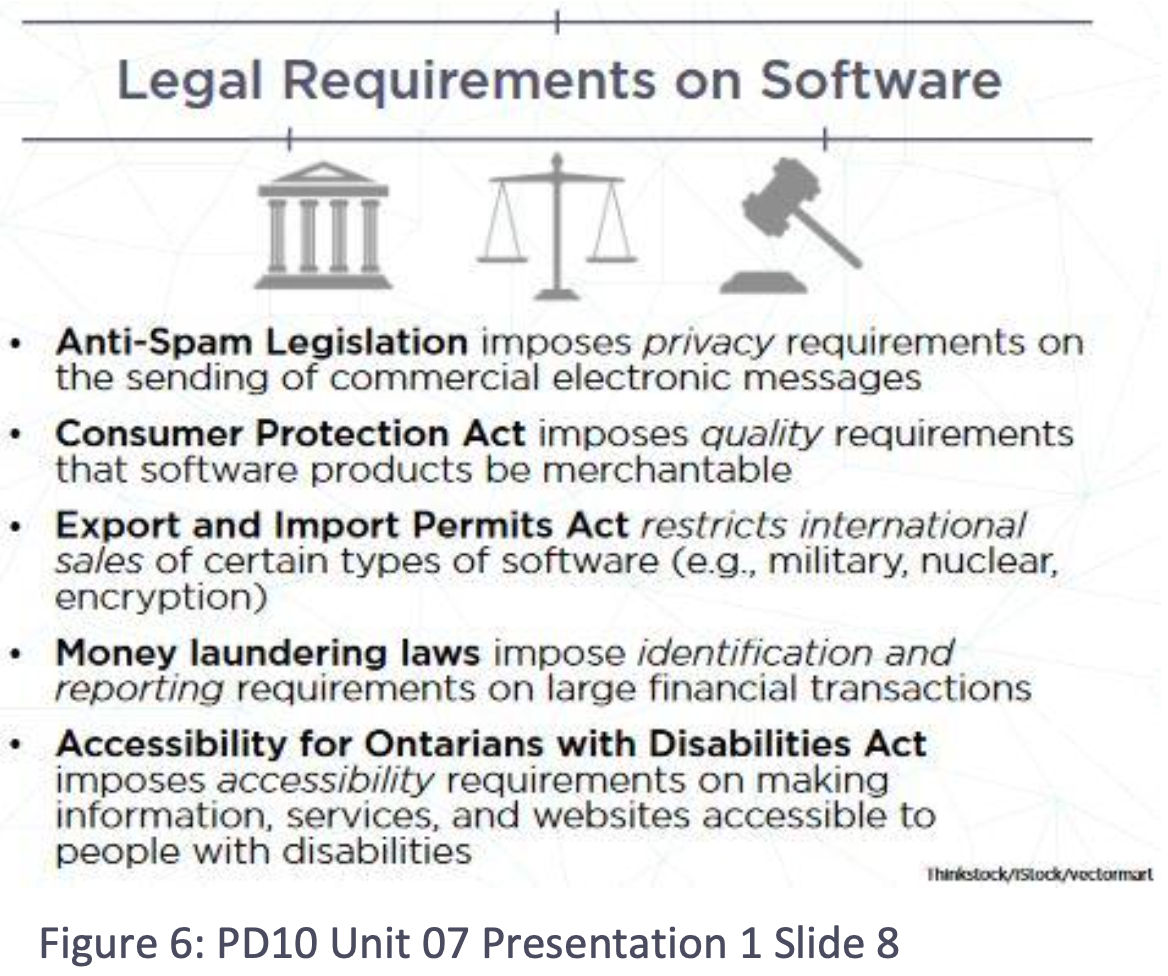

Legal Requirements on Software

These examples are all cases where software technologies interact with the law. In general, laws impose legal requirements on people’s actions and transactions, on the sale of products and services, and on the freedoms, restrictions, and reporting of information.

When software systems automate these activities, the software itself must adhere to the same laws. In effect, the software is acting as an agent for the user and is therefore subject to the same laws as the user.

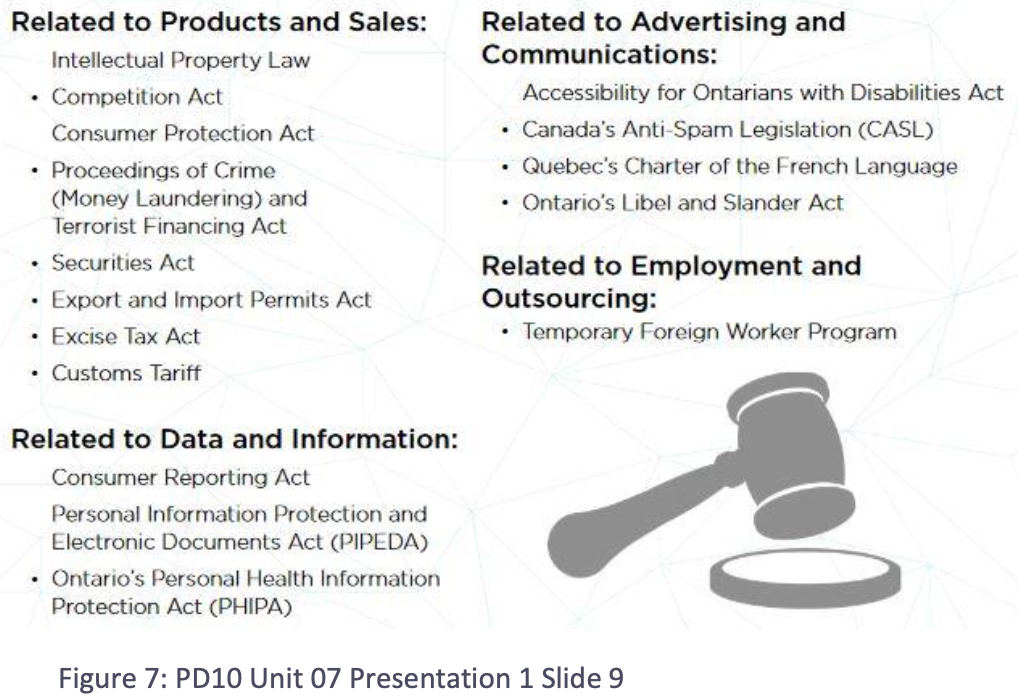

Lots of Laws

There are lots of laws!

This course explores only a handful of the laws that have an impact on software products, their development, their creators and their users. If you are developing new software, you need to spend some time, early in the development process, determining whether there are any laws that apply to your work. Consider hiring a lawyer to help you make this determination!

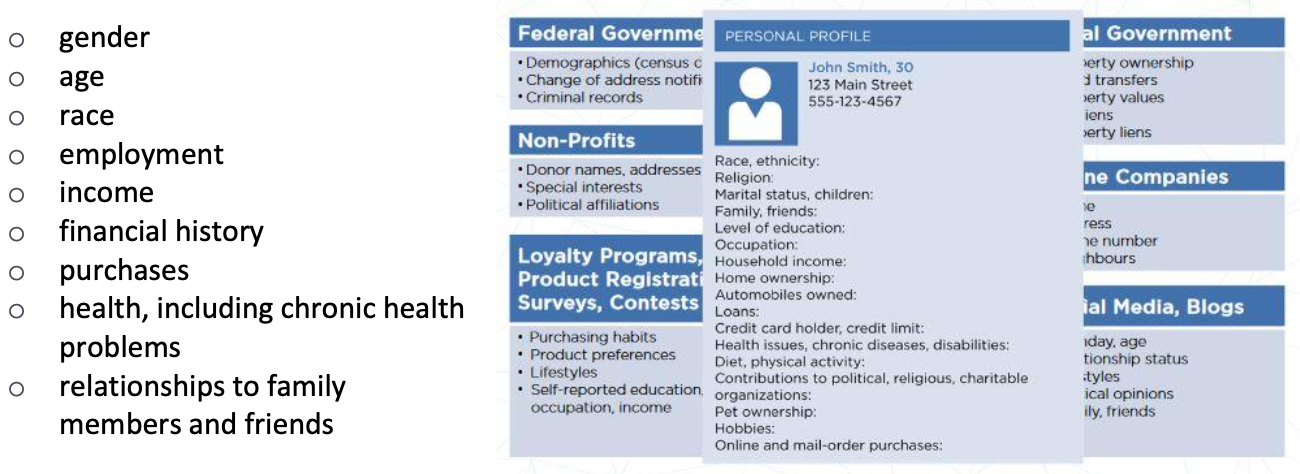

Consider another example: the data broker industry, which is a software industry that has been in the news because of its legal problems.

Data Collection Personal Profile

Data brokers collect and infer personal information from a number of different sources.

A considerable amount of information can be obtained from public records (such as court records of marriages, divorces, bankruptcies, criminal convictions, and traffic violations), as well as from public directories of addresses and phone numbers. The post office provides information about current addresses. The provincial government keeps public records of various types of licenses and registrations. Municipal governments keep public records of property ownership, liens, and property values. Credit lenders and collection agencies provide regular reports to credit-reporting agencies, informing them of credit applications, individuals’ outstanding debts and history of debt payments. Insurance companies provide regular reports of filed claims.

In addition, the vast majority of Canadians provide free information about themselves to companies, whenever they subscribe to loyalty programs, complete marketing surveys, enter store contests, or fill out a product registration or warranty card. This information is then sold to data collectors and brokers.

Even more information is captured from public internet sites and blogs, or is accessed directly from social-media databases.

Individually, these various data provide a partial record of an individual’s personal and consumer history. Just imagine what happens when a data broker merges information from all of these different sources!

Taken together, they can provide a surprisingly complete personal profile, including personal information about:

What happens to these personal profiles?

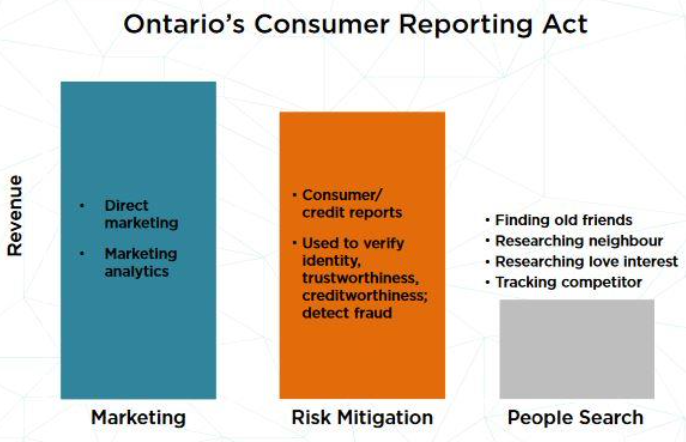

Marketers make the heaviest use of this information through direct marketing. Information in personal and aggregate profiles can help marketers to target advertisements to those consumers who are most likely to respond favourably.

Personal profiles are also used in “people” searches - for example, when a person employs a service to locate old friends or to learn about a new neighbour or a potential date.

The most critical use of personal profiles is within a consumer report or a credit report. These reports provide personal information and credit or criminal histories that can be used to assess the identity, trustworthiness, or creditworthiness of an individual. Employers, creditors, and landlords use consumer or credit reports to help them make decisions about offering employment, extending credit, approving loans, underwriting insurance policies, or renting property.

Any company operating in Ontario that acts as a consumer-reporting agency requires registration. Moreover, it is legally obligated to ensure that the information it provides is based on the best, most- reliable, most up-to-date evidence.