Q1:

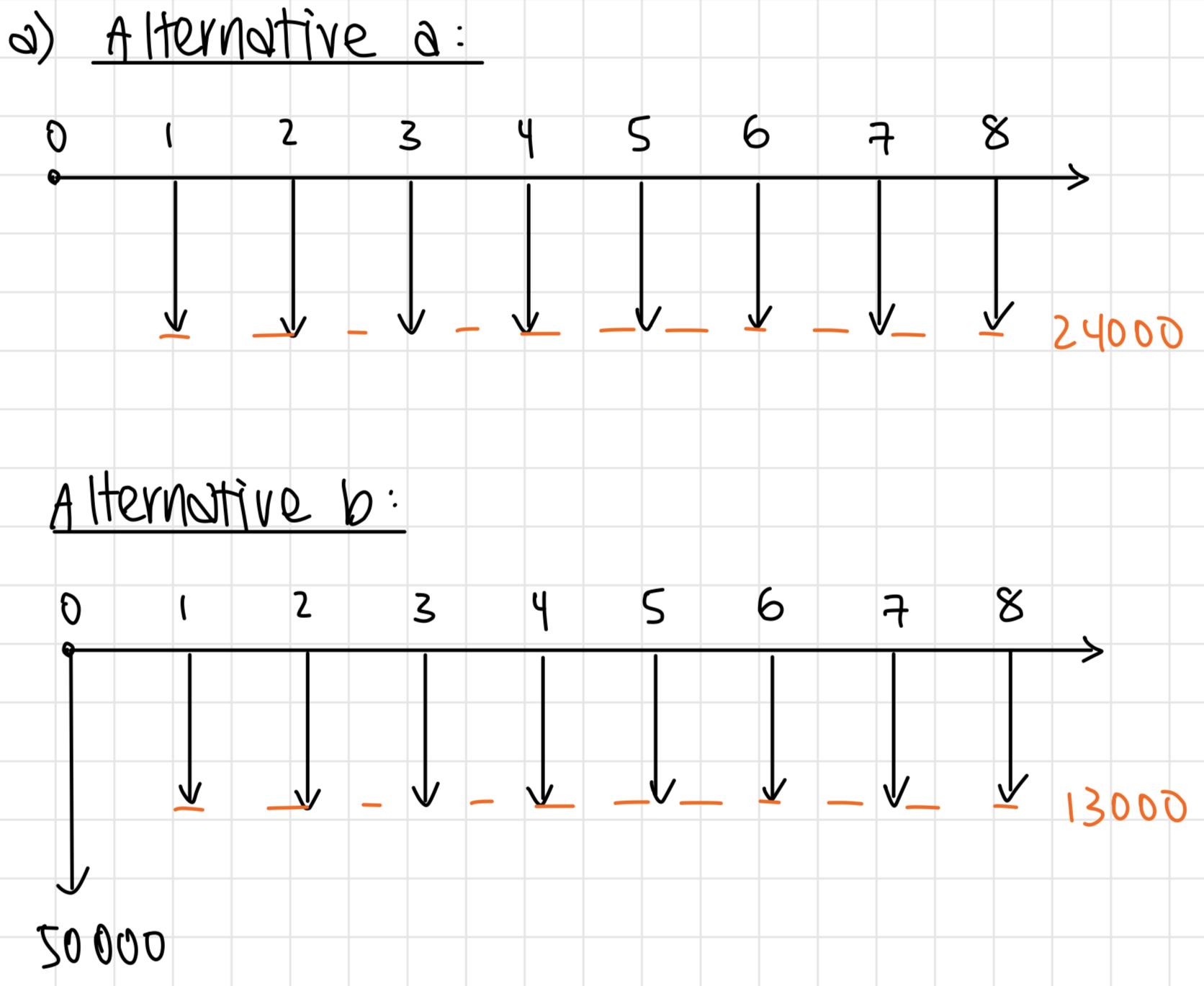

a):

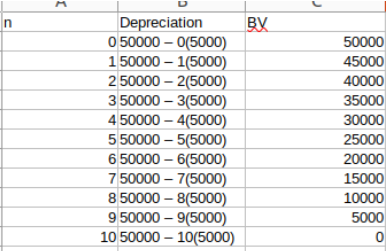

We can use straight-line depreciation to find a depreciation rate of 5000 per year. BV and depreciation schedule is as follows:

b)

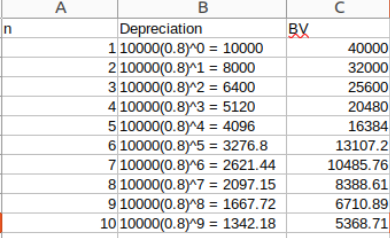

With declining-balance depreciation, the depreciation schedule and BV are here:

Q2:

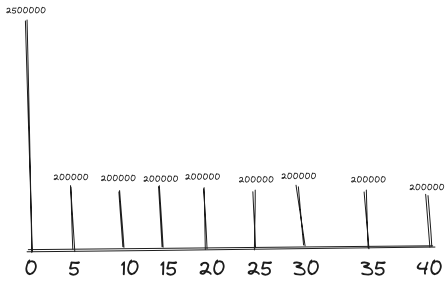

Since O&M occurs every 5 years, we need to get an adjusted : every 5 years

The PW of the costs associated with this design (N = ) = 2500000 + (, 61.05%, ) 200000 = 2500000 + = 2827600.33

If the pool’s service is reduced to 40 years, then we have $200,000 annuity.

= 2500000 + (, 61.05%, 8) 200000 = 2820361.66

Q3:

a)

Given MARR = 8% yearly, the effective interest rate for O&M every 3 years is

every 3 years

So by BCR, this project is viable.

b) Modified BCR: O&M counts as one of the disbenefits.

So by modified BCR, this project is viable.

Q4:

a) Equating to equal repeated lives, we have LCD(4, 6) = 12

For the CR1000

(At n = 12, we don’t need to re-purchase, we just have to scrap it)

Using AW, we don’t worry about repeated lives, so we just calculate with one lifecycle (N = 4):

For the CRX:

Again, at n=12, we only scrap it.

Using AW, we don’t worry about repeated lives, just calculate it using one lifecycle (n = 6)

Better to pick CRX with its MARR of 12%.

b) Find the salvage value where CR1000 is a better option.

So the CR1000 needs to have a salvage value of 816 or more to make it the superior option.

Q5:

Find the value of such that NPW = 0.

Via linear interpolation:

The IRR is roughly 23.99%. Since our IRR (23.99%) > MARR (14%), this is a viable project.

Q6:

a): Find the monthly payment sent to the bank

Monthly payment:

= $166530.75 \text{ monthly payment}b):

Q7:

a)

b)

Using interpolation, we get:

Between not doing anything and option B, we choose option B since it’s greater than the MARR and option B has a higher initial cost.

Using linear interpolation:

We choose option B between B and C. This is because we’re less than the MARR, and option B has a lower initial cost. So the best option is B, based on comparisons.

Q8:

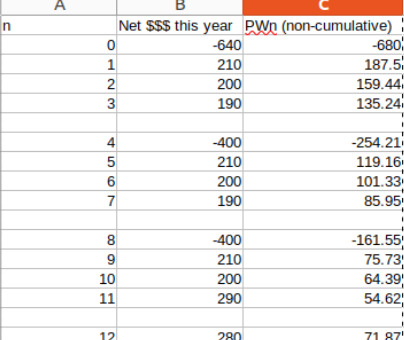

a)

b) For a 10% increase in MARR:

c) Find the break-even (when PW = 0) If x is some number of hours:

Q9:

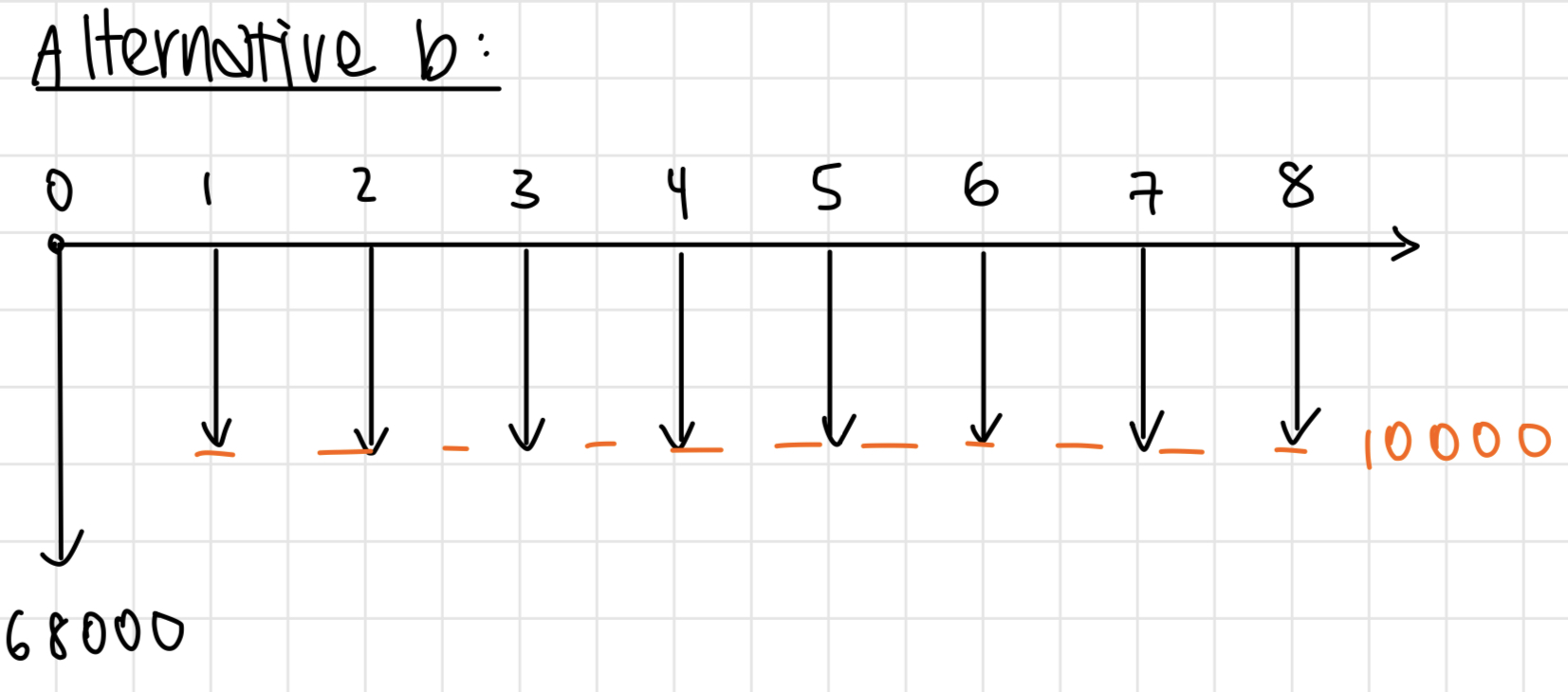

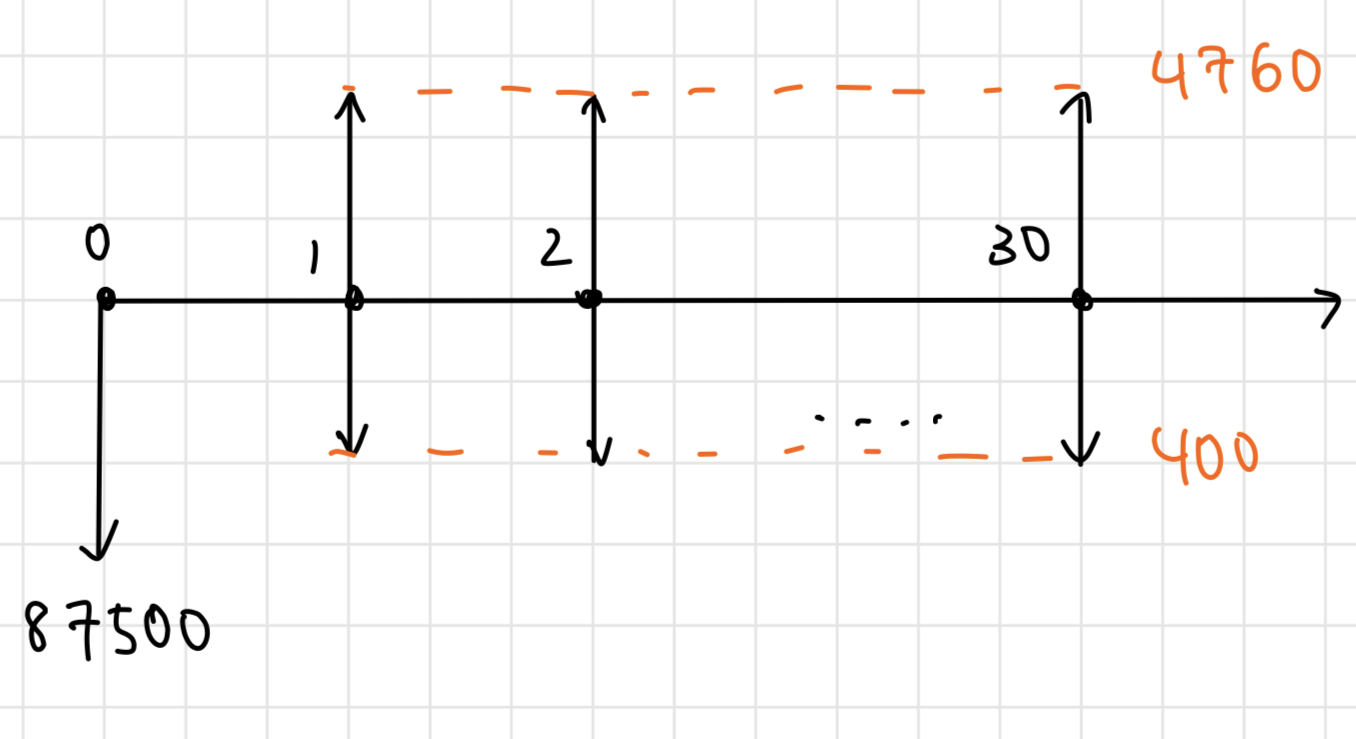

a) For the PV system:

For the wind system:

b) For this PV system: Initial cost O&M cost = $ Cash of the excess power4760$

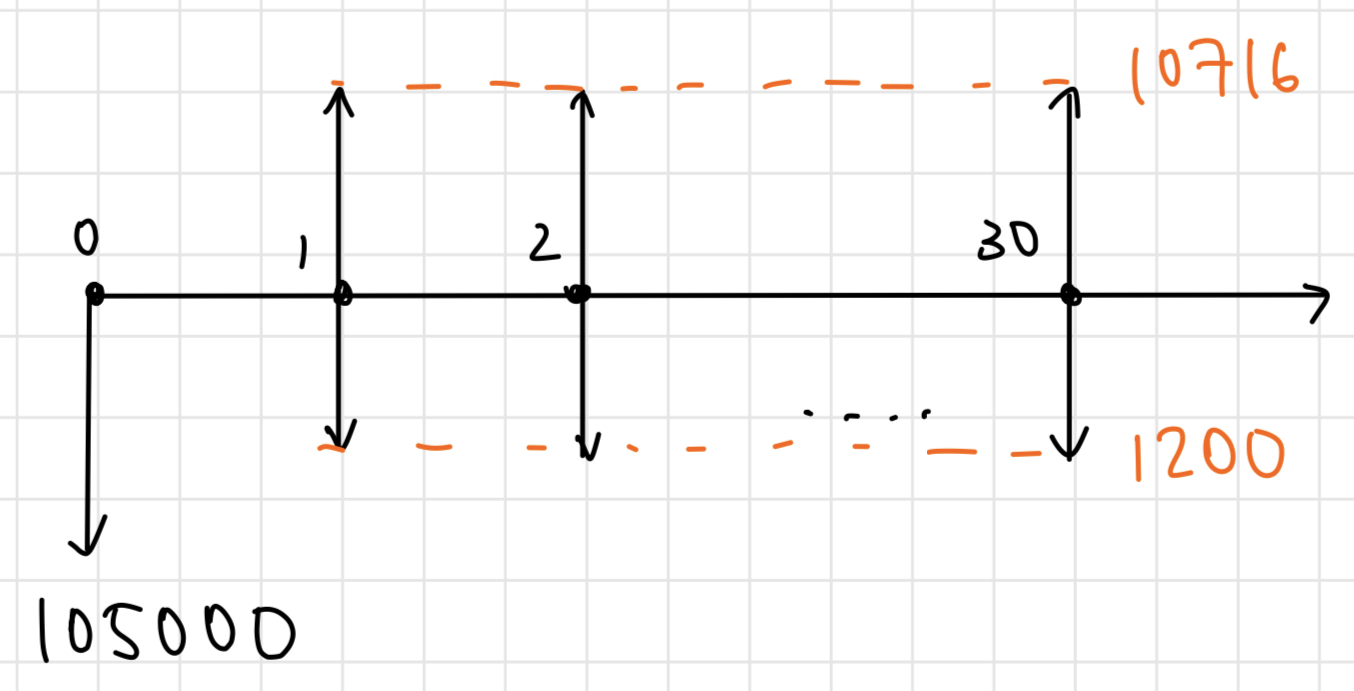

For the wind system: Initial cost = (35)(3000) = $105000

O&M cost = $\frac{1200}{year}$$

Cash of our excess power = (73.58 - 20)(1000)(.2) = $10716

c) For the PV system: Payback period = =

For the wind system: Payback period =

d) Since our projects are mutually exclusive, we’re allowed to use the method

Option 1: Do nothing Option 2: Install the PV system Option 3: Install the wind system

Cost of not doing anything = $

0 = -87500 - (400 - 5000)(, ^*, 30) + 4760(,i^*, 30) = -87500 + 9360

= 0.101 0.101 < 0.12, so we choose to do nothing.

0 = -105000 + (1200 - 5000)(, i^*, 30) + 10716(, i^*, 30) 0 = -105000 + 14516 = .135 .135 > .12

Thus, we choose option C.

Happy farm should choose to go with the wind system.

Q10

a) ![[IMG_323103D91974-1.jpeg|]]

b) EV 98000$

EV 93250$

EV = minimum of (EV and EV) = $93250

EV =

EV _4

EV = minimum of (, )

Since EV < EV, and < , we choose to test them, then to make a minor modification if our result is unfavourable.

c) From b), we know EV = and = 93250.